Maybe you’ve heard it before, but degree choice matters. It matters because you should be genuinely interested in what you’re learning, and it could affect your income after you graduate.

Let’s take a closer look at how your major can affect your future salary.

Which degrees are the best bang for your buck?

While it’s important to study something that interests you, it’s equally important to understand that college is an expensive thing to pay for.

Much of your early earnings are probably going to go toward paying any student loans you took out. The lower your student debt, the more of your earnings you get to keep after graduation.

According to a recent study done by Georgetown University, grads in the following fields of study had the least amount of student loan debt to pay depending on the school they went to:

- Cosmetology and related personal grooming services

- Allied health and medical assisting services

- Environmental control technologies/technicians

- Electrical/electronics maintenance and repair technology

- Precision metal working

This is likely due to the fact that most of these fields only require an undergraduate certificate, not an associate degree or higher.

Paired with lower costs of attendance, grads in these fields can benefit from earnings up to $42,000 per year.

Some college majors make more money after graduation

In general, college majors in science, technology, engineering, and mathematics (or STEM), as well as business subjects like accounting and finance, have greater earning potential than other majors.

Certain majors also carry less risk in the ability to make student loan payments due to differences in average starting salaries.

For example, students majoring in drama and theater arts can expect an average starting salary of $27,000 per year.

Compare that to computer science students, who can expect, on average, $58,000 a year after graduation.

The difference is nearly double, but there’s more to this picture.

Earnings can vary widely between schools

Grads with the same major at different schools can also see a variation in earning potential.

For example, the starting salary for a bachelor’s degree grad from Fordham University who majored in accounting is $71,351 (before taxes).

Compare that to accounting graduates from Virginia State University, who can expect a pretax starting salary of $28,019.

Not what you’d expect, right? This variation can happen for a lot of reasons:

- A school’s reputation overall or within that major

- Which NCAA conference a school is in (Ivy League, PAC 12, Big 10, etc.)

- Where a school is located

- What NCAA division it’s in (Division I, II, or III)

Choosing a major (and school) that’s right for you

Choosing the right school is about as important as choosing what you’ll go to school for. But with tens of thousands of degree programs to choose from, the search can be complicated.

Think about the jobs you’re interested in. If you know anyone in those fields, it may be a good idea to connect with them. See if they’ll let you ask questions about their work and how to enter their industry.

If you’re not able to ask someone working in the field that interests you, speak with a career counselor to learn more about jobs and industries you find interesting.

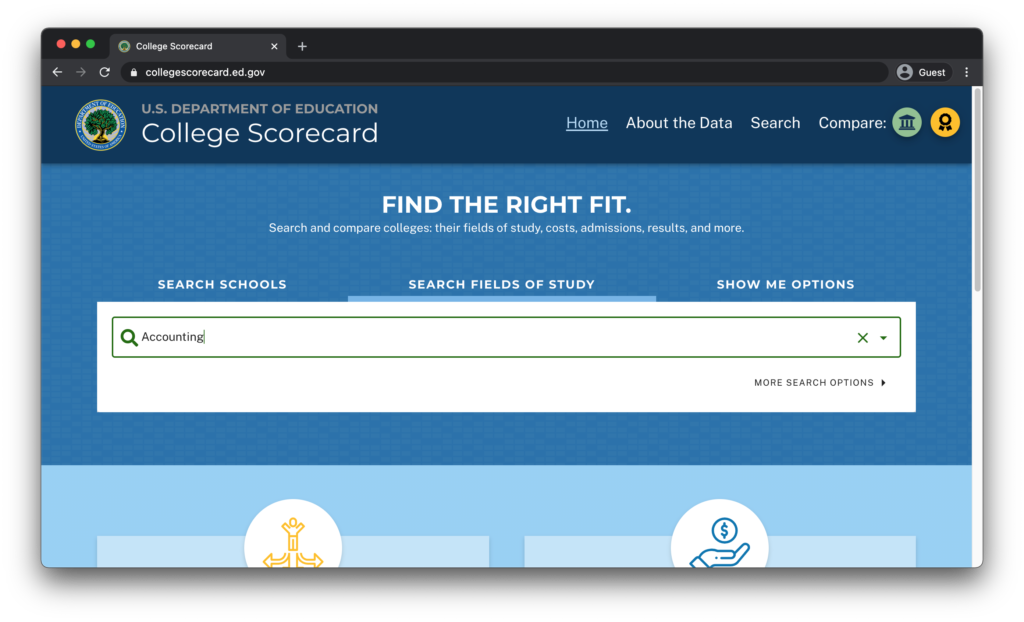

And for a look at the earning potentials and student loan repayment outlooks of different majors and schools, tools like the College Scorecard can help.

What is the College Scorecard?

The College Scorecard is a tool created by the U.S. Department of Education to help you compare schools and degree choices. It allows you to easily and quickly search through over 37,000 college programs.

Using the College Scorecard, you can filter by schools and fields of study to find out:

- Where a school is located and the school size

- What kind of degrees are available at certain schools

- What the typical earnings are in a field of study

- What your student loan repayment might look like

It’s a powerful tool that can help you in the search for the best college for your dollar.

How do I use the College Scorecard?

First, head over to the College Scorecard. Then, decide whether you’d like to search by school or by field of study. If you’re not sure which schools you’re interested in yet, try searching by your intended major or field of study. For our example, we’ll choose Accounting.

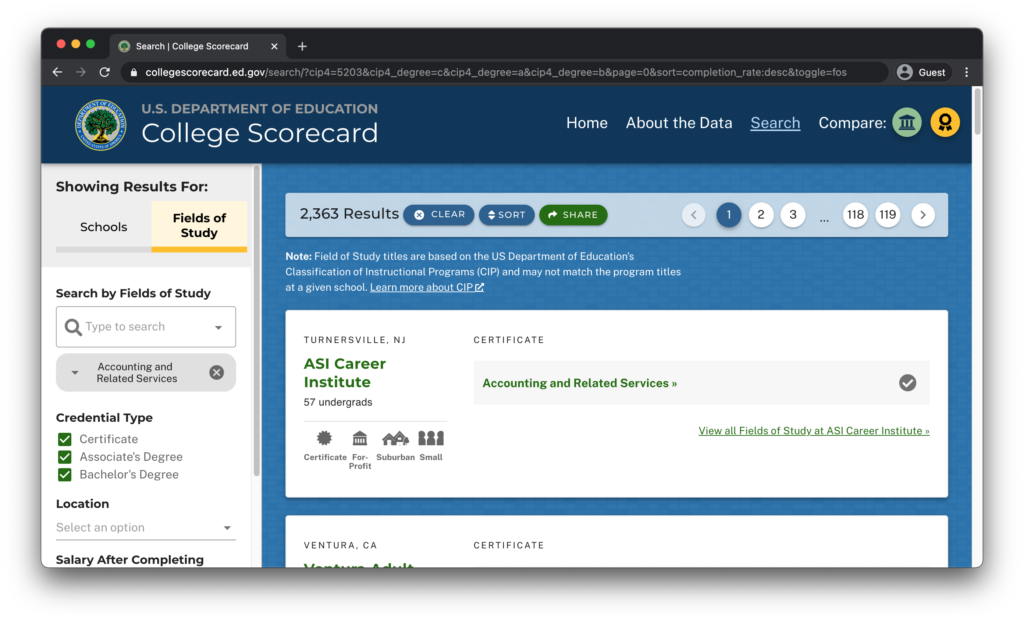

Searching by field of study will display all the schools that offer majors or certificates in that field. In our example, we’re seeing all the schools that have programs for Accounting and Related Services.

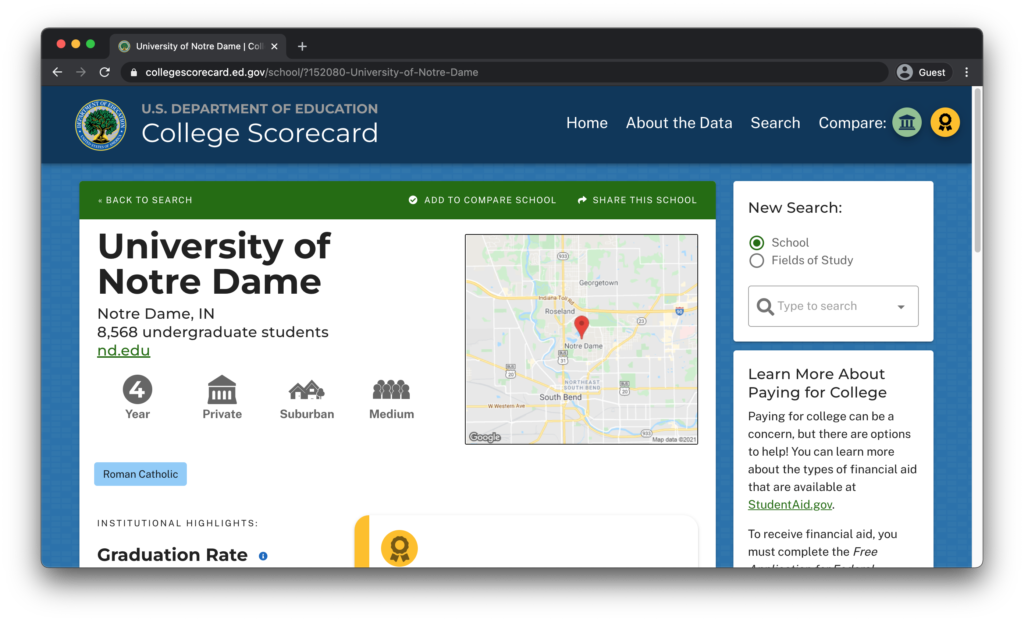

When you see a school that interests you, you can click on its name. This will take you to the school’s page, where you can learn more about the school, how its graduates are repaying their student loans, and what other fields of study they offer degrees in.

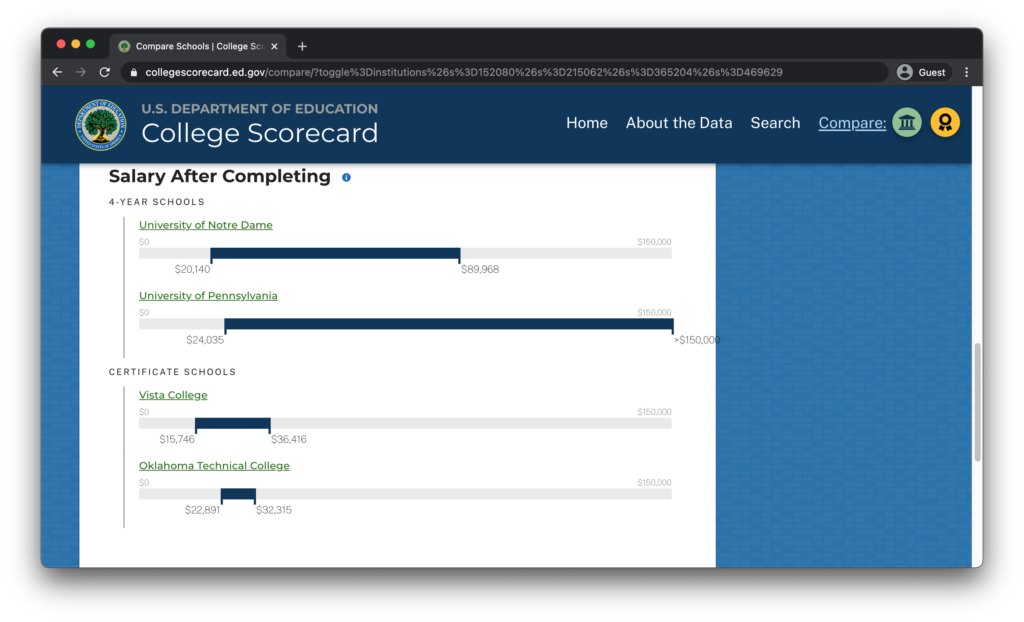

You can even add schools or fields of study to a list to compare them. This comparison shows the average annual cost of each school, their graduation rates, and salary ranges for graduates.

Putting it all together to pick a college and major

It’s a big decision to go to college. Don’t ignore a major’s potential future earnings when choosing a school and a major.

At the same time, think about the type of degree you want, school size, and your interests and values. How do all of these factors match up with the schools and majors that you’re considering?

Use what you know about your intended major’s earning potential, as well as info from the College Scorecard, to compare schools and fields of study. That way, you can be empowered to take the best path to completing your college journey.

About Melanie

About Melanie

I am a Financial Coach for college students and parents. I am an Accredited Financial Counselor (AFC®) and received my BBA in Management from Texas State University. I help students understand their financial aid and help them develop a plan to achieve their educational and financial goals. I was a first-generation college student, so I have a personal understanding of some of the struggles students face.

Working in the financial aid industry for 13 years has given me the opportunity to work with students at different points in their life from starting college to graduating and finding a job — all the way through helping them repay their student loans and save for the future.

This service is not intended to constitute any tax, investment or legal advice. If you need investment, legal, tax advice, and/or credit counseling, please consult with a professional within those areas.

Links to third-party financial resources are provided as a convenience for informational purposes only. Trellis Company does not endorse or approve any of the products, services or opinions of the entities or individuals associated with these links. Trellis Company bears no responsibility for the accuracy, legality or content of any external site associated with the links provided or any subsequent links.

|

Read this to me

|